China’s Changing Demographics Impact on US Inflation

The population of China has seen a record decline over the past decade. At first glance, this may seem encouraging; after all, resources are scarce, and lower population numbers could mean more economic goods available to share. Unfortunately, a decaying population rate affects much more than initially meets the eye. The decreasing population in China has the potential to dramatically increase inflation and cause massive economic fluctuation across the globe. This piece will cover the population trends in China, their financial ramifications, and some potential scenarios to prepare for the changes.

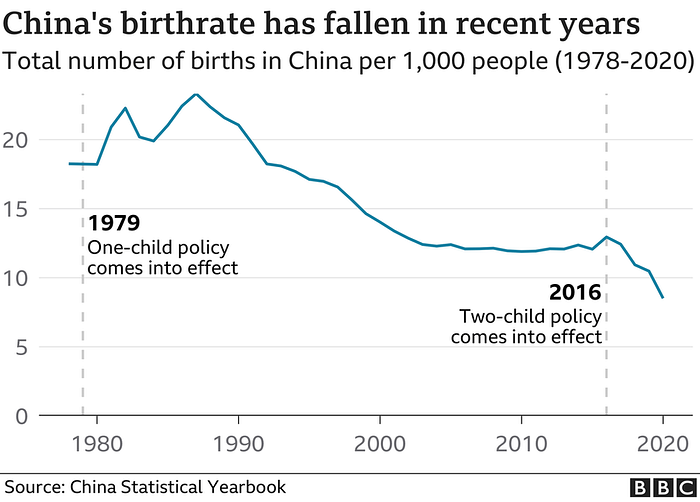

Declining Population trends in China: China’s population is growing at its slowest pace in decades, with figures from a census released on Tuesday showing that China faces a demographic crisis that could stunt growth in the country. China imposed a one-child policy in 1980 to slow down population growth which local officials often enforced with draconian measures. Many argue that this policy is one of the primary causes of the slow-growing population as it prevented up to 400 million births and decreased the number of women of childbearing age. According to the census, China’s population has now reached 1.41 billion people. Since the previous census, China’s population grew by 72 million people; it is the smallest increase in percentage terms since the Chinese government conducted its first census in 1953. Only 12 million babies were born in China last year, the fourth year in a row that births have fallen, making it the lowest official number of births since 1961. The fertility rate for the year, 1.3 children per woman, was far below the 2.1 level needed to maintain the population. In addition to the one-child policy, unwillingness to rely on immigration, high divorce rates, and increasing reluctance to start families because of the rising costs of raising children all contribute to China’s declining population.

How shifting demographics can induce inflation: In their book “The Great Demographic Reversal: Aging Societies, Waning Inequality, and an Inflation Revival,” Charles Goodhart and Manoj Pradhan assert that workers produce more than they consume while dependents — children and retirees — consume more than they produce. Since the reduction in workforce establishes a greater proportion of retirees to workers, demand for goods and services will exceed supply. The most probable way the market will return to equilibrium, where the demand equals the supply, would be an increase in prices. This increase would come when a significant portion of the population relies on savings as their primary financial backing with little to no other source of revenue. As the China’s population ages, and there is a reduction of available labor there, unless other steps are taken, there will be a corresponding pressure on supply as production costs will increase. These costs most likely will be past along to the consumers — and in the case of the US, since it’s own population is also aging, it will result in inflationary pressures rising as demand will continue to increase.

Potential Solutions: Fortunately, the issue is widely recognized, and countries and economists are actively exploring solutions. China recently updated its childbearing policy, allowing families to have up to three children, hoping it will lead to an immediate increase in population and labor force. Other countries like India with a larger share of younger demographics could also invest in their infrastructure to fill any emerging gaps. In America, President Biden has recently introduced legislation that would see a quarter-trillion-dollar investment in building up America’s manufacturing and technological edge. Both political parties in the US embrace the enormous investment directed at semiconductor manufacturing, artificial intelligence research, robotics, quantum computing, and a range of other technologies. This investment in automation and artificial intelligence aims to take the brunt off workers and allow for a market equilibrium without massive inflation. Some of these policy options may have their own set of inadvertent consequences; however, it will be prudent to prepare for the longer-term impact on the global economy due to these demographic changes.